When you lose your job, you may find yourself looking for lifelines to help you get through this rocky period. One of those lifelines may be unemployment insurance. If you make a mistake on your claim, you may accidentally delay those funds. You can do it right by reading this quick overview of the unemployment application process.

Determine Your Eligibility

Before filing your claim with California’s Employment Development Department (EDD), determine if you are eligible for benefits.

Eligibility Requirements

To get unemployment benefits, you must meet all requirements when you apply and when you certify for benefits.

Requirements to Apply

When you apply for unemployment benefits, you must:

- Have a Social Security number, or have authorization to work in the United States (if not a US citizen).

- Have earned enough wages during the base period.

- Be fully or partially unemployed.

- Be unemployed through no fault of your own.

- Be physically able and available to work.

- Be looking for work each week.

- Be ready and willing to accept work right away.

The base period is a specific 12-month period that tells us if you earned enough to set up an unemployment claim. To learn more, review How Unemployment Benefits are Computed (DE 8714AB) (PDF).

If you qualify, your weekly benefit amount will be between $40 and $450. You can use the unemployment benefit calculator to get an estimate of what you might receive.

If you think you are misclassified as an independent contractor, please apply. We will let you know if you qualify for benefits.

Requirements After You Apply

- Weekly Benefits Certification Requirement

- Work Search Requirement

- What Happens If You Quit or Get Fired

Collect Your Information

The next step is to collect the necessary information to complete the unemployment application process. Gather all the pertinent information about your former employer.

Last Employer

- Last employer information including company name, supervisor’s name, address (mailing and physical location) and phone number. If you are self-employed, a business owner, or an independent contractor, list yourself as your last employer.

- Last date worked and the reason you are no longer working.

- Total gross earnings in the last week you worked, beginning with Sunday and ending with your last day of work. If you are self-employed or an independent contractor, you will need your net income (total after taxes).

Employment History

- Information on all employers you worked for during the past 18 months, including name, address (mailing and physical location), the dates of employment, gross wages earned, hours worked per week, hourly rate of pay, and the reason you are no longer working.

- If you are self-employed or an independent contractor, you will need your net income (total after taxes).

- Notice to Federal Employees About Unemployment Insurance, Standard Form 8 (former federal employees only).

- DD 214 Member 4 copy (ex-military only).

Identity Documents

We launched ID.me, a safe and easy way to verify your identity in UI Online. When you file a new claim, you will be redirected to the ID.me site where you will take a selfie (personal photo) and upload a photo of your ID to verify your identity.

To get more information, review Top Nine Reasons Your Document May Get Rejected (PDF).

For help

For the ID.me verification process, you can:

- Speak to an ID.me video agent 24 hours a day, 7 days a week, through your ID.me account.

- Visit ID.me Support and submit a request for help.

- Review How to Set Up and Protect Your ID.me Account (PDF).

Visit the UI Online Site

When you turn to us, we have a program or resource that can help. Unemployment benefits are here to help support you and your family while you find a new job and develop your career.

Use myEDD—the fastest and most convenient way to apply for unemployment and manage your claim.

Note: To apply for benefits online, you must be at least 18 years old. If you are underage, you can apply by phone, fax, or mail.

Technical Assistance?

For more information on UI Online, use these helpful resources, including video tutorials and FAQs.

- UI Online Videos

- Everything You Need to Know About UI Online (FAQs)

- How to Set Up a UI Online Account (DE 2338H) (PDF)

- UI Online Poster (DE 2338P) (PDF)

UI Online Help

If you need help with account setup or login issues, call 1-833-978-2511 and select option 1 after the introductory messaging. The phone line is available from 8 a.m. to 5 p.m. (Pacific time), Monday through Friday, except on state holidays.

You must first have a myEDD account to register for your UI Online account.

Create a myEDD Account

Once you submit your , you will receive an email to confirm your account. Select the link provided to complete your registration. The link will expire within 48 hours.If you don’t get this message in your inbox, check your spam or junk mail folder.

Once you are logged in to myEDD, select UI Online and provide the following information to register:

- First and last name as it appears on your claim

- Date of birth

- Social Security number

- EDD Customer Account Number

The EDD automatically mails your Customer Account Number to you within 10 days after you file a claim.

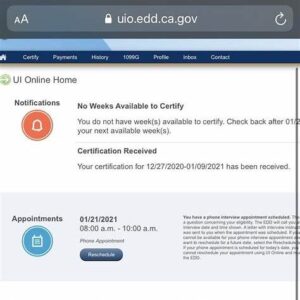

UI Online Features

- File or reopen a claim.

- Certify for benefits and report work and wages.

- Monitor claim and payment status.

- Update personal information.

- Schedule or reschedule phone interviews.

- Access tax documents.

EDD Phone Eligibility Interview

When you apply for unemployment insurance benefits in California, the EDD may require you to undergo an eligibility interview. If the EDD identifies a potential eligibility issue with your Unemployment Insurance (UI) claim, they will initiate a process and schedule a phone interview with you. During the interview, an EDD representative will ask you questions about your claim. They will use the information you provide to decide whether you qualify for UI benefits. You can learn more about how to prepare for the interview here:

- 5 Tips for Preparing for Your EDD Interview – Pershing Square Law Firm, PC – Case Management Knowledge

- How to Prepare for an Unemployment Insurance Phone Interview With the EDD – Pershing Square Law Firm, PC – Case Management Knowledge

What to Expect

- Notification: You’ll receive a notice with the date and time of your interview.

- Preparation: Be ready to discuss your employment history, reasons for job separation, and availability for work.

- During the Interview: Answer all questions truthfully and provide any requested documentation promptly.

For more information, visit: Unemployment Insurance – After You Apply

Additional Resources

- Contact EDD: For assistance, call 1-800-300-5616 (Monday through Friday, 8 a.m. to 5 p.m. Pacific Time). More contact options are available here: Contact EDD.

- Certify for Benefits: Learn how to certify for benefits every two weeks to continue receiving payments: Certify for Unemployment Insurance Benefits.

If you have filed an unemployment claim but EDD denied you benefits, contact Pershing Square Law Firm. Our EDD lawyers can help you get benefits faster and work with you to make the best decisions in your