When applying for Unemployment Insurance (UI) or State Disability Insurance (SDI) benefits, one of the most critical factors that affect your eligibility and benefit amount is the base period (BP). This term may sound technical, but understanding how it works can be the key to successfully navigating your claim and ensuring you receive the full benefits to which you are entitled.

In this guide, we will explore the meaning of a base period, the different types of base periods used by the Employment Development Department (EDD), eligibility criteria, how to locate your Weekly Benefit Amount (WBA), and the options available if you wish to challenge.

Regular Base Period

The standard rule is that the EDD skips the quarter in which you file your claim and the quarter immediately preceding it and then considers the four quarters prior to those two quarters. This is known as the Regular Base Period (RBP).

Example of (RBP):

If you filed a claim in April 2025 (second quarter of 2025):

- The quarter of filing is: Q2 2025 (April – June 2025)

- The quarter immediately preceding is: Q1 2025 (January – March 2025)

- Your (RBP) would be: Q1 2024 to Q4 2024 (January – December 2024)

The wages you earned during this base period determine whether you are eligible for benefits and how much you can receive on a weekly basis.

Alternative base period

Alternative base periods, or ABPs, are now found in twelve states, most of them adopted just in the past few years. Basically, ABPs allow more workers to qualify for benefits by updating the system for tracking an individual’s recent earnings which are needed by many workers to satisfy the states’ monetary eligibility rules. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for UI benefits.

How does it work?

It has typically four calendar quarters. (The calendar quarters are January through March, April through June, July through September, and October through December.)

Example of ABP:

If a claim is filed in April 2025:

- RBP excludes Q1 and Q2 2025, and uses Q1 – Q4 2024

- If not enough wages in RBP, then ABP would consider: Q2 2024 to Q1 2025

The ABP is especially helpful for workers who recently returned to the workforce, changed jobs, or whose highest earnings were in more recent quarters not included in the RBP.

What are the costs of ABPs?

According to a national study of the states that have adopted the ABP, the costs of administering ABPs have not been significant. On average, the benefits paid out of the UI trust funds have increased by 4-6%. Given the comparably large numbers of workers who benefit from ABPs, this cost is justified. In calculating the costs of ABPs, these estimates do not take into account that a fair proportion of workers would have eventually drawn UI if they remained unemployed and filed later, valid UI claims.

Who can we call for help?

The National Employment Law Project provides advice and support for policymakers and advocates relating to unemployment insurance, including ABPs. Contact California’s Premier EDD Law Firm:(866)790-1211 or contact us at support@pershingsquarelaw.com.

Special Base Period (SBP)

In exceptional circumstances, where a claimant cannot establish eligibility under either the RBP or ABP, the EDD may apply a Special Base Period (SBP)—but only for State Disability Insurance (SDI) claims.

Under this method, the EDD may go further back into your earnings history to identify quarters in which wages were reported, provided specific qualifying conditions are met. This is a rare exception and is not applicable to Unemployment Insurance (UI) claims.

Eligibility for The SBP

You can ask for a special base period, if your current base period was negatively affected by:

- Military service

- Industrial disability

- Trade dispute

- Long-term unemployment

Contact PFL at 1-877-238-4373 to provide additional information if:

- You do not have enough base period wages. You may be able to establish a valid claim using a later beginning date.

- You do not have enough base period wages and you were actively looking for work for 60 days or more in any quarter of the base period. You may be able to substitute wages paid in other quarters.

- During your base period you served in the military, received workers’ compensation benefits, or did not work because of a labor dispute.

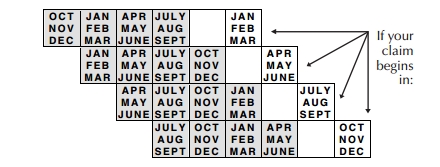

What is My Base Period?

Review the following to find your base period.

What Affects Your Payment Amounts?

Your benefits may be reduced if you:

- Have a benefit overpayment for a previous Unemployment Insurance, PFL, or DI claim.

- Have late court-ordered child or spousal support payments due.

- Are working part time, intermittently, or reduced hours.

Payment amounts for part-time workers

Note: Report all of your income to avoid overpayment, penalties, and a false statement disqualification.

Locating Your Weekly Benefit Amount (WBA)

Once the appropriate base period has been identified, your Weekly Benefit Amount (WBA) is calculated based on the wages earned during the highest quarter of your base period.

How Your Weekly Benefit Amount is Calculated

You can estimate your WBA using EDD’s Benefit Table* below.

If your highest quarterly earnings are:

Annual Income (12 months) | Highest 3-Month (Quarterly) Earnings | Weekly Benefit Amount (approximate) |

| Up to $1,199.96 | Less than $300 | Not eligible |

| $1,200 to $2,889.96 | $300 to $722.49 | $50 |

| $2,890 to $62,025.60 | $722.50 to $15,506.40 | 90% of weekly wages |

| $62,025.64 to $79,747.20 | $15,506.41 to $19,936.80 | $1,074 |

| More than $79,747.20 | $19,936.81 or more | 70% of weekly wages up to a $1,681 maximum |

*Cross-referencing your highest quarterly wage in the base period the corresponding WBA range

Example

If your highest quarterly wage during your base period was $5,000, your WBA may fall within the $190–$230 per week range (actual amounts vary per year and must be confirmed via the EDD benefit chart).

The maximum WBA for UI in California as of 2025 is $450/week, while SDI benefits typically pay 60–70% of your weekly wages, depending on income level.

You can get a general estimate by using our online calculator.

Estimate My Benefit Amount

Note: The calculator is intended to provide an estimate only. Your actual WBA will be confirmed once your claim has been approved.

Can the Base Period Be Changed?

Yes, under certain circumstances, the base period used in your claim may be subject to appeal or adjustment.

If you receive a Notice of Unemployment Insurance Award or Disability Insurance Determination that you believe is based on incorrect earnings or the wrong base period, you may challenge it by filing an appeal.

Grounds for Appeal Include:

- Incorrect computation of the Benefit Year Begin (BYB) date

- Wages reported under the wrong Social Security Number

- Omission of recent wages due to employer delay in reporting

- Inadequate earnings in the RBP when sufficient earnings exist under the ABP

Appeal Options

- File an appeal in writing within 30 days of receiving your Notice

- Request application of the ABP if wages were earned recently

- In SDI cases, request evaluation for a SBP

Conclusion

Understanding the concept of a Base Period is essential to securing the unemployment or disability benefits you are entitled to. Whether through the RBP, ABP, or—rarely— SBP, your eligibility and benefit amount depend heavily on the EDD’s assessment of your recent earnings history.

By knowing your rights, preparing your documents in advance, and understanding your options to appeal or request a different base period, you can significantly increase your chances of receiving maximum benefits. Don’t hesitate to seek assistance from legal professionals or employment advocates when faced with complex wage disputes or claim denials.